The first quarter of 2025 saw Greater Victoria’s residential real estate market regain momentum. While single‑family homes continued to command premium values, condominiums emerged as the fastest‑growing segment by sales volume, and townhouses displayed signs of stabilization after a period of price softness.

Pricing

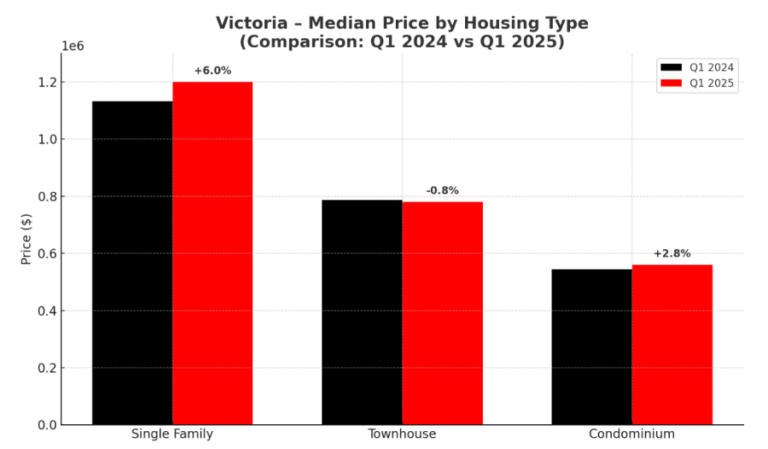

Price trends in Q1 2025 varied significantly by housing type. The median sale price for single‑family homes rose 6% year‑over‑year to $1,199,900, suggesting sustained demand for detached properties despite elevated price levels. By comparison, condominium prices increased by 2.8% to a median of $560,000. Townhouses and row units bucked the upward trend, with median prices dipping 0.8% to $779,900.

Source: VREB

Regional Price Variations for February 2025

In the context of the broader Vancouver Island region, as reported by the Vancouver Island Real Estate Board (VIREB), in February 2025, VIREB’s board‑wide MLS® Home Price Index benchmark price for a single‑family home reached $773,200, representing a 2% increase over February 2024. Condominiums across the VIREB area saw their benchmark rise by a similar 2% to $404,600, while townhouses recorded a 1% gain to $541,800.

Source: VREB

Sales

Residential sales in Victoria climbed 11% in Q1 2025 compared to the same period in 2024. Single‑family home sales rose by 4.7% year‑over‑year, while townhouse and row‑unit transactions increased by 4.4%. However, the most pronounced growth occurred in the condominium sector, where sales jumped 23.1% over Q1 2024.

Sales growth was not uniform across price ranges. In the single‑family category, entry‑level homes priced below $800,000 saw a 27.5% decline in sales compared to the previous year, while the $800,000 to $1 million segment contracted by 13.5%. By contrast, homes in the $1.2 million to $1.4 million range recorded a remarkable 44% increase in sales, and properties above $1.4 million rose by 15.6%, showing an apparent demand for higher-end properties.

Townhouses and row units also exhibited mixed performance by price band. Units under $700,000 enjoyed a modest 3.8% sales gain, and those between $700,000 and $800,000 rose by 10.4% year‑over‑year. In contrast, the $800,000 to $900,000 bracket saw a 16.2% drop in sales, while the $900,000 to $1 million segment surged 66.7%. Properties above $1 million experienced an 18.5% decline in transactions.

Condominiums recorded the broadest-based growth across all price ranges. Sales of condos under $500,000 rose 13.9%, those in the $500,000 to $600,000 range increased by 15.4%, and units priced $600,000 to $700,000 climbed by 22.4%. Even the $700,000 to $800,000 segment posted a healthy 30% gain, while luxury condos above $800,000 led the pack with a 58.7% jump in sales.

Inventory

Inventory levels in Victoria edged upward across all segments in Q1 2025, offering buyers a somewhat broader selection of homes than a year earlier. At the quarter’s end, single‑family homes had 4.2 months of inventory, up from 3.7 months in Q1 2024—a 13.5% increase. Townhouses and row units recorded 3.2 months of supply, a 14.3% rise from 2.8 months, while condominiums reached 4.1 months of inventory, up 7.9% from 3.8 months.

Time on the market also shifted slightly. The median days on the market for sold single‑family homes fell from 25 days in Q1 2024 to 22 days in Q1 2025. In contrast, townhouses and row units saw median days on the market tick up from 21 to 23.5 days, while condominiums experienced a small reduction from 28 to 26 days.