Canada’s labour market has seen notable shifts over the past two years, with unemployment rates moving higher across several provinces while others have maintained relative stability. Nationally, the unemployment rate reached 6.9% in July 2025, reflecting a continuation of the upward trend observed since early 2024. This increase follows the steady growth in the labour force and uneven job creation across sectors, indicating that the labour market is adjusting to broader economic pressures.

Data Source: Edge Realty Analytics

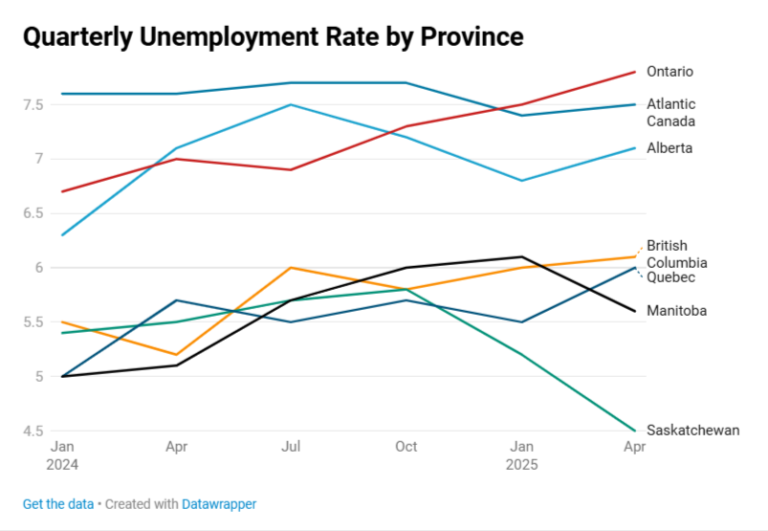

Looking at quarterly trends, provinces like Alberta and Ontario have experienced persistent elevations in unemployment. Alberta’s rate rose from 6.3% in Q1 2024 to 7.1% in Q2 2025, peaking above 7% in multiple quarters, reflecting economic fluctuations in resource-dependent industries. Ontario similarly climbed from 6.7% in Q1 2024 to 7.8% by Q2 2025, showing steady upward pressure on employment levels despite its large and diverse economy. In contrast, Saskatchewan demonstrated a declining trend in recent quarters, dropping from 5.4% in Q1 2024 to 4.5% in Q2 2025, indicating stronger job growth relative to the province’s labour force.

Other provinces show varied patterns. British Columbia’s unemployment fluctuated moderately, moving between 5.2% and 6.1% over the same period, while Manitoba saw a slight rise before stabilizing, reflecting its smaller labour market. Quebec’s rates remained comparatively low, ranging from 5.0% to 6.0%, whereas Atlantic Canada consistently posted higher unemployment, averaging above 7.5% across most quarters. These differences illustrate how regional economic structures, including industry composition and population trends, shape labour market outcomes.

Alongside these trends, key labour market indicators provide further insight into the state of employment across Canada. According to Statistics Canada, long-term unemployment remains elevated, with nearly a quarter of unemployed Canadians having been out of work for 27 weeks or more. Youth unemployment is particularly pronounced, with rates well above the national average, highlighting ongoing challenges for young Canadians entering the workforce. Among core-aged workers, those aged 25 to 54, unemployment has risen slightly, signalling that even traditionally stable segments of the labour force are feeling the effects of slower job growth and sector-specific pressures. These indicators underscore that while national and provincial rates offer a snapshot, underlying dynamics are necessary for a deeper understanding of the labour market.

| Province | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|---|---|---|

| British Columbia | 5.5% | 5.2% | 6.0% | 5.8% | 6.0% | 6.1% |

| Alberta | 6.3% | 7.1% | 7.5% | 7.2% | 6.8% | 7.1% |

| Saskatchewan | 5.4% | 5.5% | 5.7% | 5.8% | 5.2% | 4.5% |

| Manitoba | 5.0% | 5.1% | 5.7% | 6.0% | 6.1% | 5.6% |

| Ontario | 6.7% | 7.0% | 6.9% | 7.3% | 7.5% | 7.8% |

| Quebec | 5.0% | 5.7% | 5.5% | 5.7% | 5.5% | 6.0% |

| Atlantic Canada | 7.6% | 7.6% | 7.7% | 7.7% | 7.4% | 7.5% |

| Canada | 5.0% | 5.1% | 5.3% | 5.6% | 6.2% | 6.4% |