The price-to-rent ratio is a simple metric that compares the cost of buying a home to the cost of renting a comparable unit over a year. It can provide a quick screening tool for investment, as lower ratios tend to indicate that ownership is cheaper relative to rent, while higher ratios indicate the opposite.

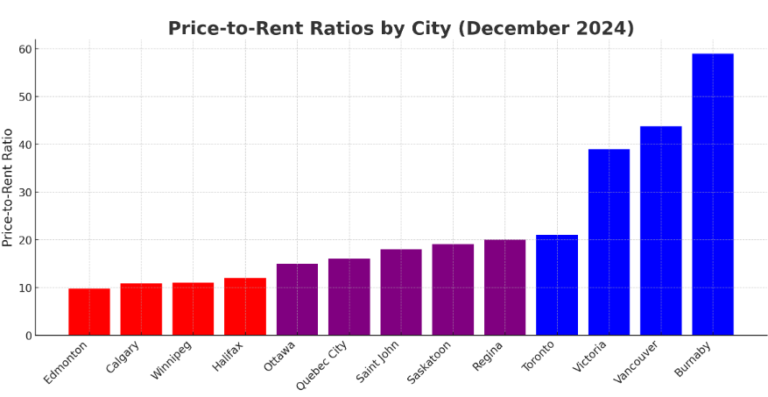

Common industry cutoffs treat ratios under about 15 as “buy-favourable,” between roughly 16 and 20 as neutral, and above about 21 as “rent-favourable.”

National Trends

On an aggregate index basis, Canada’s price-to-rent series registered at 134.71 for the first quarter of 2025, a small decline from the fourth quarter of 2024 and markedly below the 2022 peak; the index shows that prices remain high relative to rents nationally even as the gap narrows.

Numbers by City

Source: Zoocasa

Rental Yields and Cash-Flow

Gross rental yields provide the immediate income check that complements the ratio. Global Property Guide’s Q3 2025 update puts Canada’s average gross rental yield at about 5.55%, with meaningful municipal variation around that number. Because gross yield omits taxes, insurance, maintenance, management and vacancy, a conservative investor should subtract roughly 1.5 to 2 percentage points from the gross figure to estimate a plausible net yield. That means gross yields north of 6% are a more reliable starting point for conservative, cash-flow-first underwriting; weaker gross yields require an acquisition discount, low leverage, or a clear expectation of appreciation to justify a purchase.

Toronto’s average rental yield at about 6.22% for Q3, while Montreal’s average yield is around 4.40%, and Vancouver sub-markets at about 4% to 6% depending on unit type. Calgary and Ottawa appear among the stronger-yielding large cities. Remember, these are gross yields (annual rent ÷ purchase price) and do not account for taxes, vacancy, maintenance or management; net yields are typically 1.5 to 2 percentage points lower.

Source: Global Property Guide

Implications

Price-to-rent ratio and gross yield numbers can be used as complementary filters. A low ratio with a healthy gross yield suggests the raw numbers support an income deal; a high ratio with a solid yield requires careful source-of-value work (below-median purchase price, preferred financing or identifiable upside in rent). However, they should not be treated as a forecast. Instead, review deal-level underwriting using neighbourhood MLS medians, current advertised rents, conservative vacancy and capex assumptions, and stress-tested financing. Where ratios are low but yield is weak, check the supply pipeline and local regulatory risk; where ratios are high but yield is reasonable, double-check acquisition price and financing.