Canada’s commercial real estate market is sending mixed signals in 2025, with some asset classes surging while others retreat. CBRE’s Canadian Investment Overview for Q2 2025, released in September, shows that total investment volumes continue to hold steady above the $10 billion mark for the third consecutive quarter. However, while overall investment volumes remain steady, the performance across individual asset classes is far from uniform. Quarterly and yearly percentage changes highlight which sectors are attracting capital and which are experiencing a pullback.

National Investment Overview and Trends

Canadian commercial real estate investment totalled $10.5 billion in the second quarter of 2025, marking a slight decline of 1.9% quarter-over-quarter. Importantly, this is the third consecutive quarter where activity surpassed the $10 billion threshold, underscoring the sector’s recovery from the lows of 2024. Compared to Q2 2024, total investment was down 27.5%, though last year’s figures were inflated by a surge of transactions completed ahead of the capital gains tax change deadline. The number of transactions continued to trend upward, climbing 7.5% from Q1 2025 to 1,937 deals.

Source: CBRE

Asset Class Performance

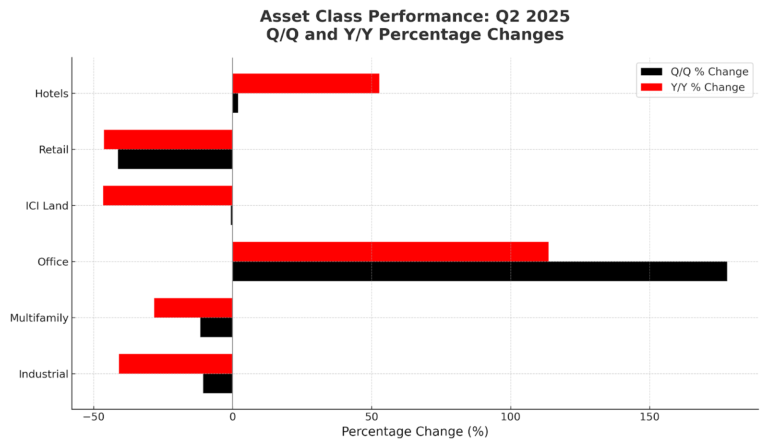

Q2 2025 revealed a Canadian investment market in contrast. Industrial and multifamily showed softening activity; industrial slipped 10.6% quarter-over-quarter, while multifamily fell 11.6%. Retail fared worse, dropping 41.2%, reflecting the slowdown following major mall transactions in the prior quarter.

Industrial, Commercial, and Investment (ICI) land remained steady, down just 0.6%, suggesting that development land continues to hold value even amid softer market conditions.

Office investment broke the trend, rising 177.9% quarter-over-quarter, driven primarily by Oxford Properties’ $1.5 billion purchase of CPPIB’s 50% stake in a seven-property Vancouver and Calgary portfolio. Hotels also saw modest growth, rising 2%, indicating selective investor confidence in hospitality assets despite broader market caution.

Purchaser Dynamics

Private Canadian investors were the most active buyers in Q2, accounting for 44.3% of acquisitions. Pension funds and advisors also played an outsized role, representing 29.2% of activity, driven by Oxford’s office acquisition. Other groups included private equity firms (13.3%), REITs/REOCs (9.6%), institutional firms (2.0%), and foreign investors (1.6%). Purchaser profiling covers deals above $10 million, offering a clear picture of the market’s most influential capital sources.

Cross-Border Investment

Foreign capital inflows reached just $86.7 million in Q2, the lowest quarterly total since Q2 2020. Nearly all foreign investment was directed into industrial properties, with 80.7% of cross-border inflows allocated to the sector. Activity came exclusively from the Americas region.

Geographic Market Highlights

While national volumes edged down, five of the nine tracked Canadian markets saw quarterly increases. Toronto maintained its position as the largest market at $2.9 billion, though its share of national totals was the smallest in more than eight years. Vancouver posted one of the strongest performances, with volumes rising 29.6% to $2.3 billion. The city led in multifamily investment and posted a 278.4% increase in office transactions. Montreal saw a 21.5% quarterly gain to $2.1 billion, leading industrial investment and recording a 395.2% increase in office volumes.

Other highlights included Calgary, where investment was steady at $1.1 billion with office volumes jumping 339.5%, and London, where total investment rose 20.2% thanks to a sharp increase in multifamily activity.