As Ontario’s provincial election approaches, it’s no surprise that housing affordability and supply have emerged as leading concerns for voters.

A new survey from Royal LePage reveals 69 per cent of Ontario adults say a party or candidate’s stance on addressing the housing crisis will influence their vote. Support for housing-focused policies is even higher among younger demographics, with 72 per cent of Generation Z and 75 per cent of millennials prioritizing the issue.

Source: Royal LePage

“Since the onset of the pandemic-induced real estate boom in 2020, housing affordability has been a growing concern, particularly in the country’s most expensive and supply-strapped markets —Toronto and Vancouver,” said Phil Soper, president and CEO, Royal LePage. “With affordability challenges reaching a crisis level, it comes as no surprise that voters – especially younger Canadians—are prioritizing housing policies as they head to the polls.

“While recent interest rate fluctuations and a temporary rise in inventory have created some market uncertainty, the underlying issue remains unchanged: a fundamental lack of supply. Sustainable affordability can only be achieved through a significant and sustained increase in housing construction.”

Housing affordability a priority for young voters

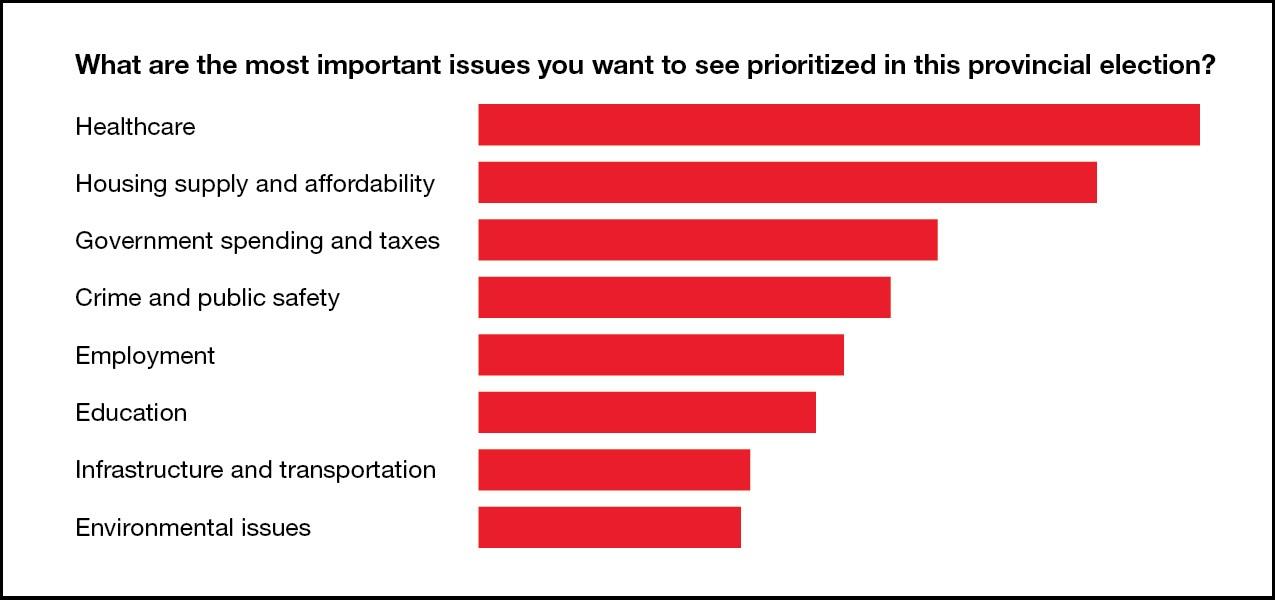

The survey found that when asked to identify their top three election priorities, Gen Z and Millennials ranked housing affordability first, followed by healthcare. Millennials placed government spending and taxes as their third-most important issue, while Gen Z prioritized employment. In contrast, healthcare remains the leading concern for Generation X and Baby Boomers.

Source: Royal LePage

Ontarians exploring alternative paths to home ownership

Given the ongoing affordability challenges, many Ontarians are considering creative solutions to home ownership. The survey found 38 per cent would consider purchasing a home in a more affordable region within Ontario, 20 per cent would consider moving to another province to find more affordable housing, 18 per cent would consider buying a property with a rental unit to help offset mortgage costs and 12 per cent would consider purchasing a home with family or friends, rather than a spouse.

However, 32 per cent of respondents said they would not consider any of these options.

Compared to older generations, younger Ontarians are more open to relocating. Twenty-nine per cent of Gen Z respondents and 25 per cent of Millennials said they would consider moving outside of Ontario in search of more affordable housing—compared to 20 per cent of Generation X and just 10 per cent of Baby Boomers.

According to the survey, 26 per cent of Ontarians who do not currently own a home plan to buy within the next two years. These prospective buyers are also more likely to explore alternative strategies to make home ownership more feasible.

“Falling interest rates over the past year, combined with stable home prices and rising wages, have provided a temporary but meaningful improvement in housing affordability, particularly for first-time homebuyers. However, this reprieve is unlikely to last beyond 2025,” Soper said.

“Pent-up demand, fueled by years of constrained supply, combined with the ongoing need for housing in a growing country, will soon outpace available inventory. Without a significant and sustained increase in housing construction, affordability challenges will persist well into the future.”