For much of this year, the Greater Toronto Area’s housing market appeared to be holding onto a fragile recovery. That narrative cracked in August.

Sales clocked in at 5,211, slightly higher than last year, but on a seasonally adjusted basis, it was the first monthly decline since March. Prices remain under pressure: the benchmark fell to $978,100, continuing a nine-month streak without gains. More importantly, the mix of which products are falling hardest is surprising even to seasoned observers.

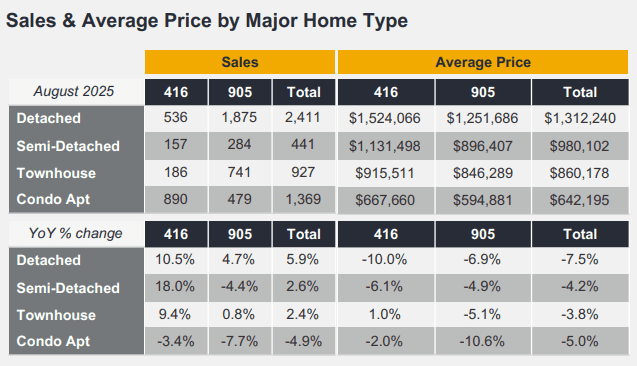

Detached homes and condos lead the decline

Conventional wisdom said 416 detached homes would prove more resilient than condos. Instead, they have posted one of the steepest drops of this cycle, down more than 10 per cent year over year, the largest decline in the core and among freehold properties. The only segment that fared worse was 905 condominiums, which fell 10.6 per cent annually. These are not marginal adjustments; they are some of the deepest corrections seen in recent memory.

Other product types were not spared either. Average prices are down across nearly every category, with one exception: 416 townhouses, up about one per cent. For investors and builders, that small uptick hints at a potential redevelopment angle. Townhouse-style multiplexes on detached lots could pencil in more favorably if the spread between detached and townhouse values persists. But that is more of a niche silver lining than a broad market trend.

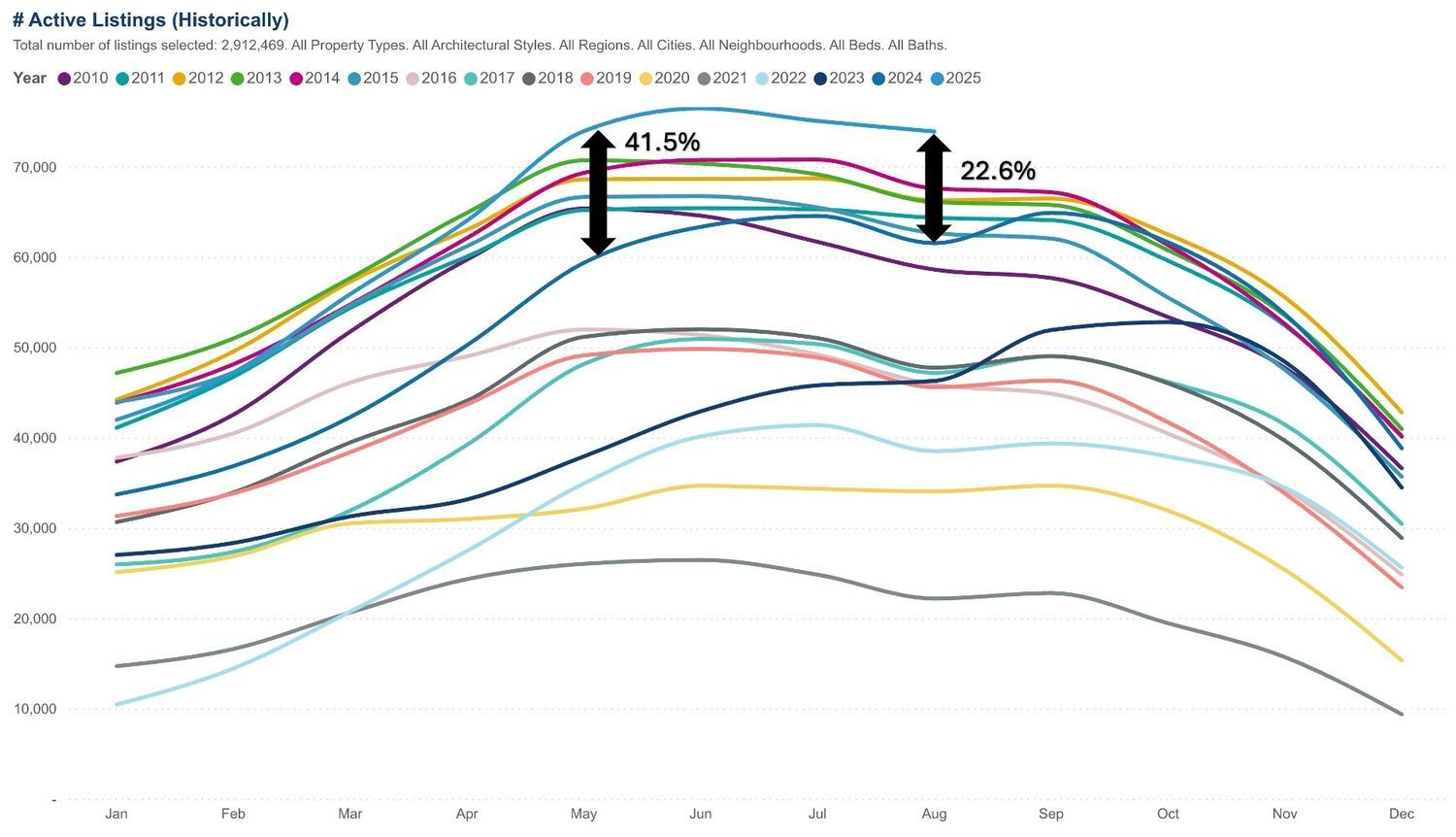

Inventory surge reshapes market power

The biggest story is not just about falling prices, but also about swelling supply. Active listings surged 22.4 per cent compared to last August, one of the largest year-over-year increases on record. Only May 2025’s 41.5 per cent spike rivaled it.

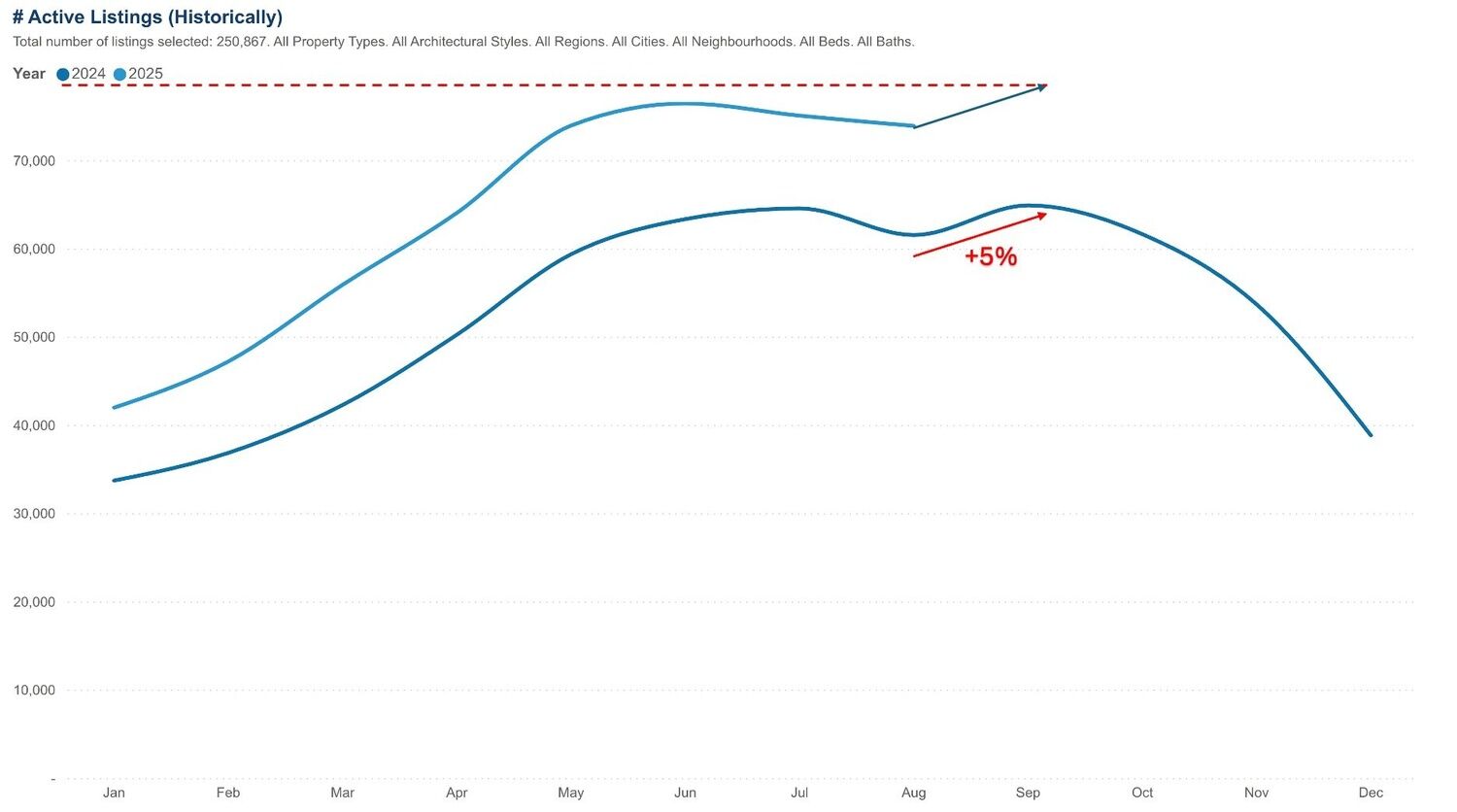

And the momentum is not slowing. Active listings historically rise in September, and early tracking suggests another record could be set. Last year, inventory jumped five per cent from August to September. With 2025 already running 20 to 40 per cent higher year over year, a comparable gain would push Toronto into uncharted territory for supply:

This imbalance is shifting the balance of power. With more options, buyers can demand price cuts. Sellers who resist price discovery face longer wait times. The average days on market rose from 29 to 33, with properties now typically taking more than a month, sometimes two, to sell.

Sales are up for the wrong reasons

TRREB and bullish analysts may point out that sales are higher than last year. But the data reveal why: more people are transacting because prices are falling, not because confidence or fundamentals have improved. In July, sales briefly outpaced new listings, hinting at demand catching up. But in August, that reversed. New listings jumped 9.4 per cent while sales crept up only 2.3 per cent. Supply growth is once again outpacing demand growth, a hallmark of deepening buyer’s market conditions.

The broader policy dilemma

The Bank of Canada faces pressure to restart rate cuts this fall. Monetary easing might pull sidelined buyers back in, but without structural affordability through higher wages and more attainable supply, it risks reigniting speculative churn. Lower rates cannot solve a market defined by abundance without affordability.

Meanwhile, TRREB has called for infrastructure spending to support growth. That is the more durable fix: aligning housing with incomes, transit, and services. Otherwise, the market risks bouncing between boom and bust on the back of credit cycles.

What this means for buyers and builders

For buyers, today’s environment is one of rare leverage. Longer days on market and swelling inventory mean bidding wars are evaporating, replaced by opportunities to negotiate. The risk is not missing out, but over-reaching, especially if prices continue to slide into the fall.

For builders, the era of assuming perpetual scarcity is over. Projects premised on constrained supply may underperform. The developers best positioned will be those who deliver family-sized units, rentals, and mixed-income communities, products resilient to speculative cycles.

A market that mirrors the economy

The GTA housing market has always been a proxy for the broader economy. Today’s weakness coincides with slowing exports in Ontario’s steel and automotive industries, pressured by U.S. tariffs. Housing, once the locomotive of economic recovery, cannot be counted on alone this time.

Whether the market stabilizes or continues correcting will hinge less on interest rates and more on structural alignment: matching supply to incomes, inventory to demand, and housing policy to the realities of the twenty-first-century economy.

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe and Mail. His expertise and balanced insights have earned him a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.