In the late-afternoon on Friday, the Hudson’s Bay Company announced that it had commenced proceedings under the federal Companies’ Creditors Arrangement Act (CCAA) to seek creditor protection, a stunning turn of events for Canada’s most historic and iconic retailer.

“After careful consideration of all reasonably available alternatives, the decision to seek protection under the CCAA was made in consultation with Hudson’s Bay’s legal and financial advisors,” the company said in a press release.

“While very difficult, this is a necessary step to strengthen our foundation and ensure that we remain a significant part of Canada’s retail landscape, despite the sector-wide challenges that have forced other retailers to exit the market,” said Hudson’s Bay President & CEO Liz Rodbell. “Now more than ever, it is critical that Canadian businesses are protected and positioned to succeed.”

“Earlier this year, we worked with potential investors to refinance a portion of our credit facilities to improve our liquidity and support our business plan,” she added. However, the threat and realization of a trade war has created significant market uncertainty and has impacted our ability to complete these transactions.”

The company said it is “exploring strategic alternatives and engaging stakeholders to explore potential solutions to preserve and strengthen its business.”

Economic headwinds such as the rising cost of living, higher mortgage rates, and the weakening Canadian dollar have resulted in tempered discretionary spending by consumers, the company said. The pandemic-induced shift to working from home has also created a significant reduction in foot-traffic in downtown cores, where many Hudson’s Bay stores are located, and the recent trade war with the United States also created economic uncertainty that impacted refinancing efforts, the company said.

Unlike lender-initiated receivership proceedings, creditor protection proceedings under the CCAA are often initiated by companies themselves. Companies are usually granted an initial protection period of 10 days, after which companies can continue to apply for extensions as needed. While under protection, companies usually restructure their operations, which often takes the form of selling off certain assets.

While the goal of a receivership is for the lender to sell whatever they can to recover their debt, the goal of creditor protection is to allow the company to come out the other end and continue operating. Serving as the court-appointed Monitor is Alvarez & Marsal, which also handled the creditor protection cases for Bed Bath & Beyond Canada, Nordstrom Canada, and The Body Shop, among other insolvencies of retailers and real estate companies.

Financial Distress And Debt

According to court documents, for the 12-month period ending January 31, 2025, Hudsons’ Bay Canada generated earnings before interest, taxes, depreciation, and amortization (EBITDA) of negative $67.9 million and a net loss of approximately $329.7 million.

Also as of January 31, 2025, Hudson’s Bay Canada’s net assets had a total book value of $3.7 billion. Its liabilities have a net book value of $3.2 billion.

In terms of debt, the company is carrying $1.1 billion of outstanding secured debt obligations as of March 7, comprised of approximately $724.4 million in mortgage debt and $405 million pertaining to three credit facilities.

“The Credit Facilities share the same collateral and security package and are subject to two intercreditor agreements between the parties,” the Monitor noted in a pre-filing report.

A breakdown of Hudsons’ Bay Canada’s outstanding debt as of March 7, 2025.

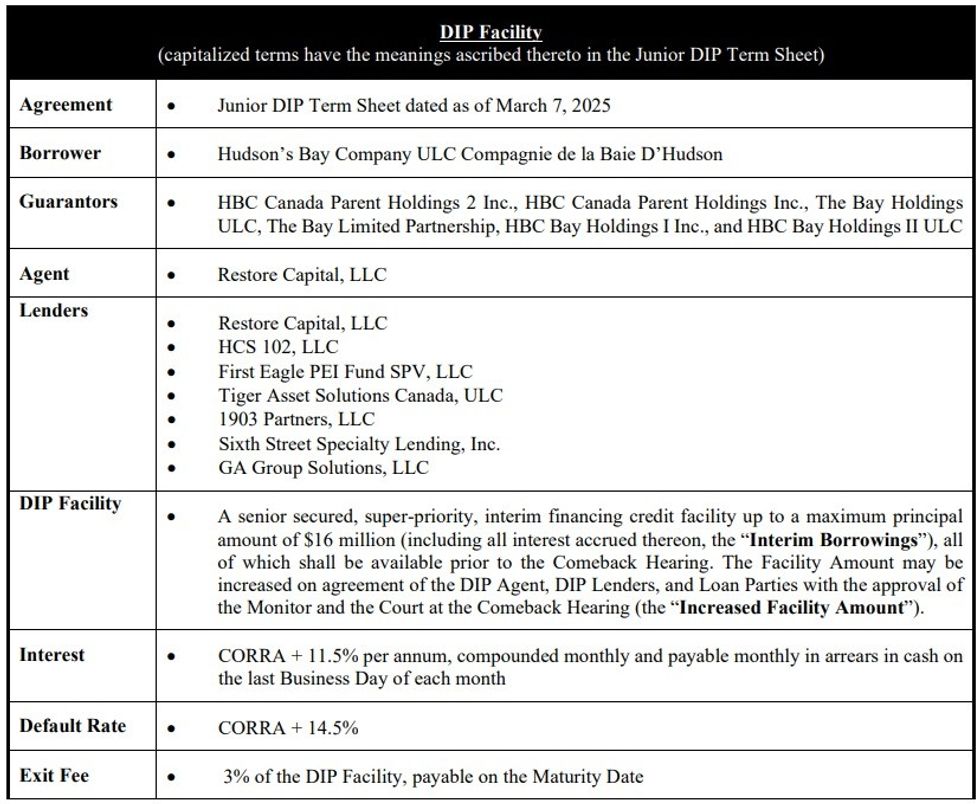

According to the company’s press release, Restore Capital LLC — an affiliate of Hilco Global — and other lenders — HCS 102 LLC, First Eagle PEI Fund SPV LLC, Tiger Asset Solutions Canada ULC, 1903 Partners LLC, Sixth Street Speciality Lending Inc., and GA Group Solutions, according to court documents — have committed to providing interim debtor-in-possession (DIP) financing during this initial 10-day period.

The DIP facility is in the amount of a $16 million advance, which was approved earlier today. The borrower is Hudson’s Bay Company ULC Compagnie de la Baie D’Hudson, with its parent companies serving as the guarantor. The DIP facility has an outside maturity date of June 30, 2025, with interest accruing at the Canadian Overnight Repo Rate Average (CORRA) + 11.5% per annum.

Following the 10-day period, Hudson’s Bay will then be seeking additional financing to fund its operations while it embarks on its restructuring.

Details of the debtor-in-possession (DIP) facility being provided by Restore Capital LLC.

Details of the debtor-in-possession (DIP) facility being provided by Restore Capital LLC.

The Hudson’s Bay Company

“The CCAA process will allow Hudson’s Bay to restructure its operations, streamline costs, and refocus on its core strengths,” the company added in its press release. “Through a license agreement, Hudson’s Bay Company ULC has a small footprint of Canadian Saks Fifth Avenue and Canadian Saks OFF 5TH stores. These stores will also continue to operate. The CCAA proceedings do not affect US-Saks Global, which is a standalone entity distinct from Hudson’s Bay Company ULC.”

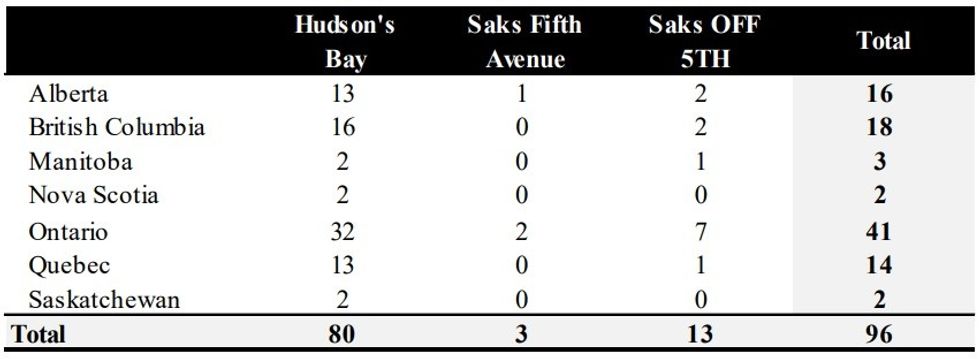

The Hudson’s Bay company currently operates a total of 96 stores across Canada, split between 80 Hudson’s Bay stores, three Saks Fifth Avenue stores, and 13 Saks OFF 5TH stores.

As of February 28, the company employed a grand total of 9,634 employees, 647 of whom work under a collective bargaining agreement.

A breakdown of stores in Canada operated by Hudson’s Bay, by brand name and location.

A breakdown of stores in Canada operated by Hudson’s Bay, by brand name and location.

Founded in 1670, Hudson’s Bay is one of the oldest companies — if not the oldest company — in North America. It is the most prominent department store in Canada, as well as the country’s largest and most iconic, regularly serving as the official outfitter for Canada during the Olympic Games.

The company went public in November 2012, listed on the Toronto Stock Exchange, but was then taken private by a group of then-existing shareholders for $1.1 billion on March 3, 2020 — days before the world shut down as a result of the COVID-19 pandemic.

“The longlasting impact of pandemic-related closures in Canada continued to reshape consumer behaviours and put additional pressure on the retail sector in Canada,” said the Monitor in a pre-filing report. “Hudson’s Bay Canada’s business has not recovered to the level it was operating at prior to the COVID-19 pandemic and the post-restructuring success that it had planned for has not materialized.”