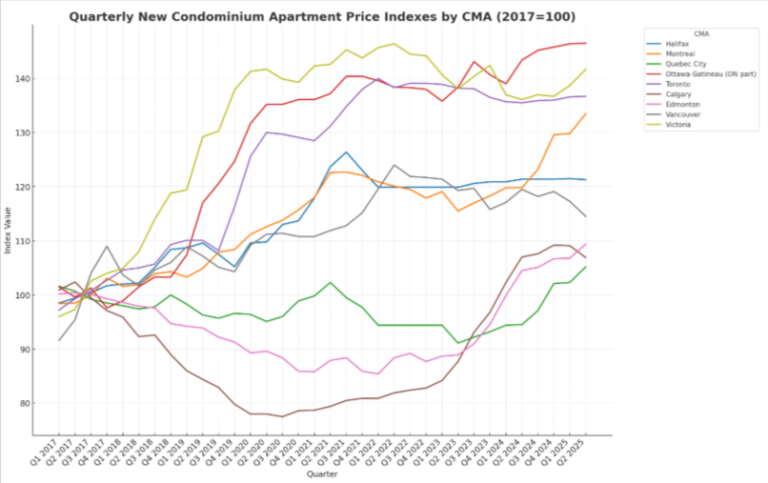

Statistics Canada has released the latest New Condominium Apartment Price Index (NCAPI) figures for Q2 2025, which show continued divergence across Canada’s major urban condo markets. While Alberta’s largest cities recorded some of the strongest gains, several previously overheated markets appear to be stabilizing or pulling back.

The NCAPI tracks quarterly changes in the prices of newly constructed condominium apartments sold by developers in nine major census metropolitan areas (CMAs). The index excludes resales and focuses on new units sold by developers. Unlike broader housing price measures, the NCAPI is designed to capture pure price movements in newly built condo supply, controlling for differences in unit features, size, and location, making it a useful tool for watching urban housing trends. It does not reflect broader housing market trends outside of newly built condos.

Source: Statistics Canada

Q2 2025 Highlights: Alberta Leads, Toronto Levels Off

Vancouver

Vancouver, which peaked at 124.0 in Q2 2022, declined for the third consecutive year to 114.5, resulting in roughly an 8% drop from its high. The pullback may reflect affordability limits, high carrying costs, or weaker demand for pre-construction units.

Victoria

Victoria edged up to 141.7, regaining ground after a slight pullback in 2023. Prices remain just below the Q2 2022 peak of 146.4, but the market appears stable.

Calgary

Calgary continues to lead the country in price growth for new condos. The city’s index jumped to 106.9 in Q2 2025, up from 78.0 in Q2 2020, with a 37% increase over five years.

Edmonton

Edmonton shows a similar trend, rising from 85.4 in Q1 2022 to 109.4 in Q2 2025. After a long period of stagnation, the city’s new condo market appears to be in recovery.

Toronto

Toronto remains near its post-pandemic plateau, with a Q2 2025 reading of 136.7, virtually unchanged from the previous quarter and below its Q1 2022 peak of 140.0. While prices are holding steady, growth momentum appears to have slowed, suggesting a more balanced new condo market.

Ottawa-Gatineau

The Ontario portion of Ottawa-Gatineau reached 146.5 in Q2 2025, edging up from 146.4 in Q1, marking a new high. The capital’s condo market has shown consistent growth since 2019, supported by population growth and limited new inventory in central locations.

Montréal

Montréal continued its steady upward trajectory, climbing to 133.5 in Q2 2025. Although the pace has moderated from its rapid rise in 2021 to 2022, it remains one of the stronger-performing markets nationally.

Québec City

Québec City, while historically more affordable, saw its index rise modestly to 105.2, continuing a slow recovery after dipping below 95 during 2022.

Halifax

Halifax edged down slightly to 121.3 in Q2 2025, from 121.5 in Q1. Price growth in the city has levelled off after rapid gains during the pandemic-era migration boom.