Source: Statistics Canada

The New Housing Price Index (NHPI) is a monthly measure from Statistics Canada that tracks price changes for newly built ground-oriented homes, including single-family, semi-detached, and row houses. It reflects the selling prices builders charge for comparable units over time, excluding condos and resale properties. By holding home specifications constant, the NHPI isolates real price movement driven by market forces such as construction costs, labour, and land value.

The NHPI offers insight into how the cost of newly built homes changes over time, indicating pressures in construction input costs (materials, labour), lot availability, and developer pricing behaviour. It helps reveal when and how quickly new‑build prices are accelerating, potentially preceding resale price movement or signalling supply constraints in the market.

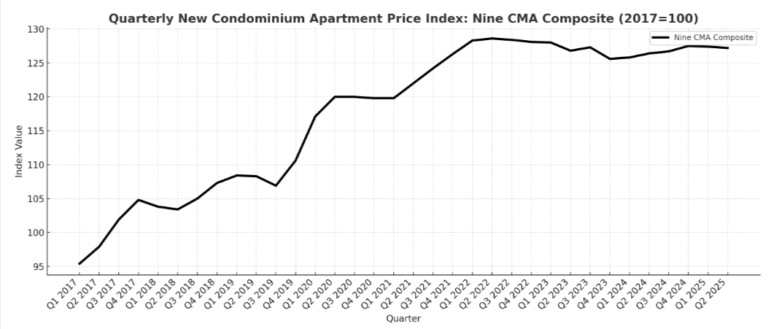

2020 Rise Levelling Off

From approximately early 2020 onward, the NHPI exhibits a pronounced and sustained rise, with the Total (house and land) index climbing sharply, peaking at 126.1 in mid-2022 before moderating.

During the first six months of the COVID‑19 pandemic (February–August 2020), new housing prices rose by about 2.3%, compared with a –0.2% change over the same span in 2019. This surprising rise was likely driven by sharply higher demand for larger detached homes versus condos, low mortgage rates, limited supply of finished lots, and rising construction costs, including lumber and labour, as well as an increased value placed on ‘home’.

While both components rose sharply between 2020 and 2022, the House Only index increased slightly more than the Total index, suggesting that structure-related costs were the main driver during that period.

After pandemic-era construction slowdowns, housing starts rebounded in 2023. According to Canada Mortgage and Housing Corporation (CMHC), housing starts were up significantly in major urban centres in 2023, relieving some of the upward pressure on prices caused by previous supply bottlenecks. Builders have also adjusted pricing strategies in response to weakened buyer demand. NHPI values remained below their 2022 peak throughout 2024 and into mid-2025.

Tariffs and Material Costs Haven’t Yet Translated Into Higher Prices

While tariffs on materials remain a source of cost pressure for builders, these costs have not led to significant post-2022 NHPI increases. One potential reason is that softening demand has made it difficult for developers to pass those costs on to buyers. According to CMHC’s 2024 Housing Market Outlook, input cost inflation began to ease by late 2023, largely due to improved supply chain conditions and lower commodity prices, particularly for lumber and steel.

However, the effects of tariffs have not yet been fully felt and may exert greater influence on construction costs and pricing in the months ahead.