Non-bank lenders are continuing to maintain a consistent presence in Canada’s residential mortgage market. Credit unions and mortgage investment entities (MIEs) account for a substantial share of outstanding loans as of Q1 2025, within this category.

Source: Statistics Canada

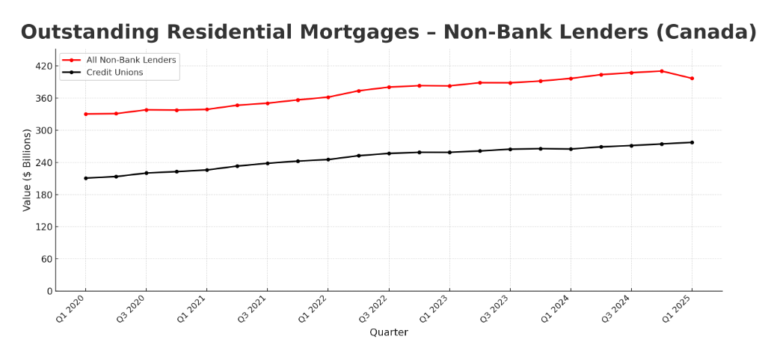

Across all non-bank lenders, residential mortgage balances stood at $396.8 billion in Q1 2025. That compares to $330.3 billion in early 2020, reflecting steady growth over the past five years with some flattening in late 2024. Credit unions made up the majority of this lending, holding $274.4 billion at the beginning of 2025, while MIEs and other non-bank institutions accounted for $119.4 billion.

Much of the non-bank lending activity is concentrated in larger provinces. Quebec recorded $147.0 billion in non-bank mortgages in early 2025, while Ontario followed with $113.5 billion, with both credit unions and private lenders active in the market. British Columbia and the Territories reported $69.3 billion, and Alberta stood at $30.0 billion.

Source: Statistics Canada

These additional financing options for borrowers and investors complement activity in the chartered banking sector. The figures suggest non-bank lenders are continuing to play a steady role alongside traditional banks. Credit unions remain the dominant players within this category, while MIEs and private lenders continue to serve borrowers seeking alternatives to conventional financing. The overall totals suggest that non-bank mortgage lending has not contracted, even with recent market and rate pressures, though growth has been less pronounced since late 2023.