A Cautionary Tale

A few years ago, we shared a story about a seller who chased the market down. It’s one of the most-read posts we’ve ever written, and it’s more relevant today than it was then. Here’s the short version:

In early 2022, we met with a seller to discuss listing their home: a great house in an in-demand neighbourhood. We valued it at $1.45 million. We recommended listing at market value, right away, because we were already seeing the market shift.

The seller disagreed. They hired another agent who told them what they wanted to hear.

The house was listed at $1.7 million in May 2022. It didn’t sell. It was relisted at $1,500,000 in June. Still overpriced. Reduced to $1,400,000. Expired. Relisted again. Reduced to $1,339,000. Expired again. By October 2022, the seller gave up trying to sell and rented the house out for $3,500 a month.

But the story didn’t end there.

In August 2023, the seller tried again, this time listing at $1,300,000. That’s $400,000 less than where they started (and $150,000 less than we originally thought it was worth). It still didn’t sell. They reduced to $1,200,000. Terminated. Again.

In June 2025, more than three years after that first listing, the house went back on the market at $1,050,000. It finally sold in September for $970,000.

Let that sink in. From $1,700,000 to $970,000. That’s $730,000 between the original asking price and what the market ultimately paid. Six listings. Three years. Countless showings, price reductions, tenant hassles and sleepless nights.

If the seller had listed at our recommended $1.45 million in early 2022 and listened to the market as it was shifting, they would have walked away with hundreds of thousands of dollars more than they eventually got, and avoided three years of stress, carrying costs, and watching their equity evaporate month after month.

This isn’t a story we enjoy telling. But it’s playing out on the MLS every day, in every community across the GTA. And in today’s market, the consequences of overpricing are more severe than ever.

The Market Has Changed. Your Pricing Strategy Needs to Change With It.

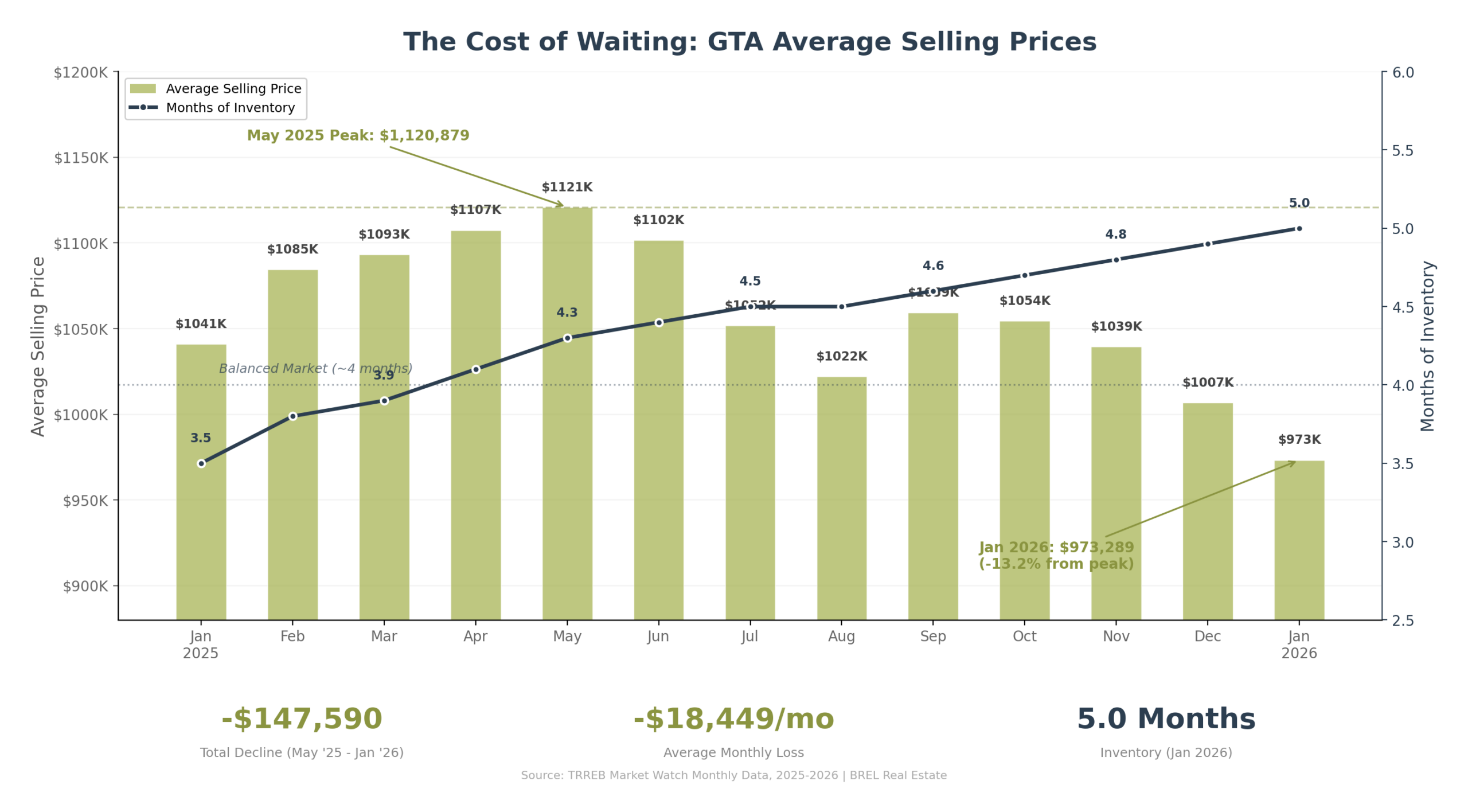

Let’s look at where we are right now, according to TRREB data:

The GTA average selling price in January 2026 was $973,289, down 6.5% from January 2025 and down 27% from the February 2022 peak of $1,334,544. Sales dropped nearly 20% year-over-year. And inventory? It’s been climbing for 12 straight months.

Here’s the number that should scare every seller who’s thinking about pricing high: the Sales-to-New-Listings Ratio (SNLR) has fallen to 0.333. That means roughly one in three listed properties is actually selling. The other two? They’re sitting. And sitting. And sitting.

Months of inventory hit 5.0 in January, up from 3.5 a year ago. In a balanced market, that number is around 4. We haven’t been in a balanced market for a while now, and we’re moving further from one, not closer. We’ve seen a steady, unrelenting slide toward buyers having more and more power. Every month that passes in a market like this, an overpriced home loses ground.

Caveat: In Toronto real estate, we deal with a lot of micro-markets, and it’s important to recognize that the numbers I referenced here are averages – what’s happening in your neighbourhood and with your type of property is what matters more than averages. Talk to your REALTOR to understand the stats that are relevant to your sale.

The Real Cost of Overpricing

Here’s what happens when you overprice your home in this market:

You Lose the First-Two-Weeks Window

The most serious buyers, the ones who are actively searching, pre-approved, and ready to act, see your home in the first 14 days. If your price doesn’t match what they’re seeing in comparable sales, they move on. They don’t make a low-ball offer. They don’t call to negotiate. They just skip you and look at the next listing.

The data backs this up:

- A US study analyzing 75,000 home sales found that a home priced within 1% of its eventual selling price had a 50% chance of going under contract within 14 days. Price it 3-5% too high? That timeline stretches to up to 52 days.

- A Zillow study found that overpriced homes requiring price cuts were 62% more likely to sit on the market beyond 60 days.

In Toronto, in January 2026, the average Listing Days on Market (LDOM) was 45 days. But Property Days on Market (PDOM) – the number that includes previous failed listings – was 67 days. That 22-day gap means a lot of homes are being listed, failing to sell, pulled off the market, and relisted. And buyers know it.

When your “new listing” is actually attempt number two or three, buyers and their agents can see it. That listing history is not a secret. And every relist signals the same thing: this seller overpriced and is now playing catch-up. It’s not a great negotiating position.

You Chase the Market Down

This is the scenario from our cautionary tale, and the math is brutal in a declining market.

Let’s say you list your detached home in the 905 at $1.35 million when the data says it’s worth $1.2 million. You sit on the market for 60 days with no serious offers. You reduce the price to $1.25 million. But over those two months, prices have slipped another 2-3%. Now your home is worth $1.17 million, and you’re still overpriced.

This is not hypothetical. The average price of a detached home in the 905 dropped from $1,319,751 in January 2025 to $1,205,859 in January 2026, a decline of 8.6%. That’s roughly $9,500 per month in lost value. Every month you sit overpriced on the market is a month you’re losing real money.

It’s worse if you’re selling a condo. Let’s say you list your Toronto condo at $750,000 when the data says it’s worth $680,000. You sit on the market for 60 days with no serious offers. You reduce the price to $720,000. But over those two months, prices have slipped another 2-3%. Now your condo is worth $665,000, and you’re still overpriced.

This is not hypothetical. The average price of a condo in Toronto’s 416 dropped from $691,039 in January 2025 to $631,932 in January 2026, a decline of 8.6%. That’s roughly $4,900 per month in lost value. Every month you sit overpriced on the market is a month you’re losing real money.

You Signal Desperation (Eventually)

There’s an irony to overpricing: it’s usually motivated by wanting to appear strong and in control, but it almost always ends with the seller looking desperate. The pattern is predictable: list high, sit on the market, reduce, sit some more, relist, reduce again. That home from our cautionary tale? It was listed six times over three years. Every buyer who pulled up the listing history could see the full story: $1.7 million, $1.5 million, $1.4 million, $1.3 million, $1.3 million, $1.2 million, $1.1 million. By the time it finally sold for $970,000, every agent in the neighbourhood knew exactly how motivated that seller was. And they negotiated accordingly.

The longer you sit, the less you get – and that’s before factoring in a declining market where the underlying value is dropping at the same time.

In a market where homes are already selling at roughly 97% of asking price, starting too high doesn’t give you “room to negotiate.” It gives buyers a reason to ignore you entirely.

And here’s one more sign that most sellers don’t consider: if a REALTOR turns down your listing, pay attention. Just last week, we walked away from a condo listing because the seller wanted $850,000 and we couldn’t justify anything above $725,000 based on the data. Think about that for a moment. A REALTOR – someone who works on commission and only gets paid when your home sells – decided it wasn’t worth their time or money to take on your listing. If the person with the most financial incentive to sell your home doesn’t believe it can sell at your price, that should tell you something.

On the other hand, if your REALTOR is suggesting you “wait it out” or “see what happens” while your home sits unsold in a declining market, you need a different REALTOR.

How to Know If You’re Overpriced

The market will tell you. You just have to listen.

- If you’ve been listed for more than 14 days without a showing request, you’re likely overpriced.

- If you’re getting showings but no offers, your home may show well but the price isn’t matching what buyers see in comparable sales.

- If you’re getting offers but they’re significantly below your asking price – and more than one buyer is landing around the same number – that’s the market telling you what your home is worth. Three buyers don’t accidentally arrive at the same number. That’s market value.

Related: We talked about this in detail in our blog The Market is Smarter Than You.

Related: In this blog, we explored all the reasons Why Your Home Isn’t Selling.

The Psychology Trap

Most overpricing isn’t strategic. It’s emotional. Sellers anchor to what their neighbour got two years ago, or what they “need” to walk away with, or what their mortgage balance is. None of that matters to the market. The market doesn’t care what you paid for your home, what you’ve spent on renovations, or what your financial situation requires.

Market value is determined by what a buyer is willing to pay, today, in the current conditions. That’s it.

In January 2026, those conditions included:

- 17,975 active listings competing for attention

- Only 3,082 sales across the entire GTA

- 5 months of inventory

- Prices that have declined every month since May 2025.

We understand the temptation to test the market with a higher price. But “testing the market” is an expensive experiment when the market is telling you – loudly, with 12 months of data – exactly where it stands.

Choose the Right Agent, Not the Highest Number

Here’s an uncomfortable truth about the real estate industry: some agents will tell you whatever you want to hear to win your listing. In the business, we call it “buying the listing.” It works like this: you interview three agents. Two of them tell you your home is worth $1.1 million based on the data. The third tells you it’s worth $1.3 million. Who do you hire? Most sellers pick the agent with the highest number. It feels good. It validates what you want to believe your home is worth. And it’s one of the most expensive mistakes you can make.

That’s exactly what happened in our cautionary tale. The seller interviewed us, heard $1.45 million, and didn’t like it. They hired the agent who said $1.7 million. Three years and six failed listings later, the house sold for $970,000. The agent who “won” the listing didn’t win anything for the seller.

The agent who quotes you the highest price isn’t necessarily the best agent – they might just be the most desperate for your business or not familiar enough with current market conditions. A good agent’s job isn’t to make you feel good about a number. It’s to get your home sold, for the best possible price, in the current market. Sometimes that means telling you something you don’t want to hear. The best agents will show you the data, explain their reasoning, and be honest about what’s realistic. That honesty might sting in the moment, but it’ll save you tens (or hundreds) of thousands of dollars in the long run.

When you’re interviewing agents, ask them to show you the comparable sales they’re using to determine their recommended price. Ask them how long those comparable properties sat on the market before selling. Ask them what’s currently competing with your home and at what price. If their number is significantly higher than what the other agents are recommending and they can’t back it up with solid data, that’s not confidence, it’s a sales pitch.

What Smart Sellers Are Doing Right Now

The sellers who are succeeding in this market share a few things in common:

- They’re pricing at or slightly below market value from day one. Not to give their home away, but to generate activity, attract serious buyers, and sell within that critical first-two-weeks window.

- They’re watching the data, not the headlines. They know what comparable homes in their neighbourhood actually sold for (not what they were listed for), and they’re pricing accordingly.

- They’re hiring their agent based on experience, strategy and honesty, not flattery. They’re choosing the REALTOR who brings them the real numbers, backs them up with data, and has a clear plan for selling in this market. They aren’t just hiring the one who tells them what they want to hear.

- They’re preparing their homes properly. In a market where buyers have choices, the condition of your home matters more than ever. Staging, repairs, and presentation aren’t optional extras, they’re the difference between selling and sitting. (Shameless plug for the BREL team: we include complimentary staging in our commission!)

- They’re staying flexible. If the data changes, they adjust. They don’t wait two months to acknowledge what the market is telling them after 14 days.

The BREL Bottom Line

Overpricing has always been risky. In 2026, it’s arguably the most expensive mistake a seller can make.

When you overprice in a declining market with rising inventory and cautious buyers, you don’t just fail to sell at your asking price, you end up selling for less than you would have if you’d priced it right from the start. Every month on the market in this environment costs you money, credibility, and options.

The market is not going to come to you. It hasn’t for 12 months and there’s no indication that’s about to change. The sellers who accept that reality and price accordingly are the ones getting deals done.

Price right from the start. React to the data. And don’t let ego cost you six figures.